Comparing the very best Secured Credit Card Singapore Options for 2024

Comparing the very best Secured Credit Card Singapore Options for 2024

Blog Article

Unveiling the Opportunity: Can Individuals Discharged From Personal Bankruptcy Acquire Credit Score Cards?

Understanding the Impact of Insolvency

Upon declare insolvency, individuals are confronted with the significant repercussions that penetrate different aspects of their monetary lives. Bankruptcy can have an extensive effect on one's credit rating, making it challenging to access credit rating or car loans in the future. This monetary stain can linger on credit history reports for numerous years, influencing the person's capability to secure favorable rates of interest or monetary chances. Furthermore, insolvency may result in the loss of properties, as specific belongings may need to be sold off to pay off creditors. The psychological toll of insolvency should not be taken too lightly, as people may experience sensations of stress and anxiety, shame, and shame as a result of their monetary situation.

In addition, personal bankruptcy can restrict job opportunity, as some employers carry out debt checks as component of the employing procedure. This can present an obstacle to people looking for brand-new job potential customers or job innovations. In general, the effect of personal bankruptcy expands past economic restrictions, influencing various aspects of an individual's life.

Variables Impacting Debt Card Approval

Obtaining a bank card post-bankruptcy rests upon different crucial factors that considerably affect the approval process. One vital element is the candidate's credit rating. Following insolvency, individuals usually have a low credit report rating as a result of the unfavorable influence of the bankruptcy declaring. Charge card companies typically search for a credit score that shows the candidate's ability to manage credit responsibly. An additional essential consideration is the applicant's revenue. A secure income reassures charge card providers of the person's capability to make prompt repayments. Additionally, the length of time because the bankruptcy discharge plays an important duty. The longer the period post-discharge, the extra positive the possibilities of authorization, as it indicates monetary security and responsible credit score actions post-bankruptcy. In addition, the type of charge card being requested and the provider's particular demands can additionally influence authorization. By thoroughly thinking about these elements and taking actions to restore credit rating post-bankruptcy, people can improve their prospects of acquiring a bank card and working in the direction of economic recovery.

Actions to Rebuild Credit History After Bankruptcy

Reconstructing credit history after bankruptcy requires a tactical strategy focused on economic technique and constant financial obligation monitoring. One efficient method is to get a guaranteed debt card, where you transfer a particular amount as security to establish a credit scores limit. Furthermore, take into consideration coming to be visit this site right here an accredited user on a household member's debt card or discovering credit-builder finances to additional increase your credit score.

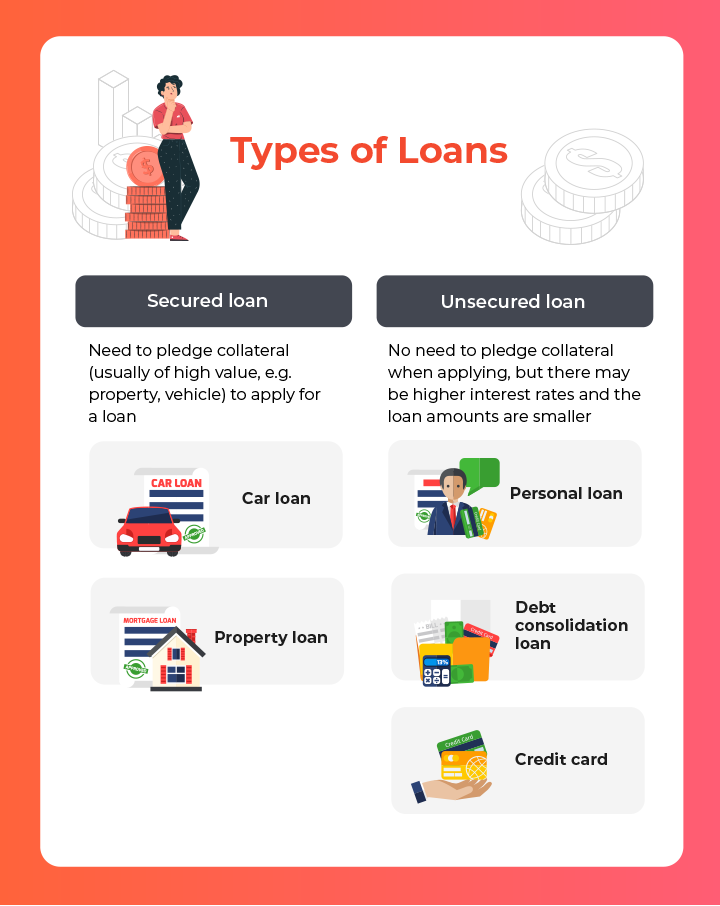

Safe Vs. Unsecured Credit Report Cards

Following personal bankruptcy, individuals usually consider the selection between safeguarded and unprotected credit cards as they intend to rebuild their creditworthiness and financial security. Guaranteed credit cards need a cash money down payment that functions as security, generally equivalent to the credit score restriction provided. These cards are less complicated to acquire post-bankruptcy considering that the deposit decreases the threat for the provider. However, they may have greater fees and rates of interest contrasted to unprotected cards. On the various other hand, unsafe bank card do not need a down payment but are more difficult to certify for after personal bankruptcy. Issuers evaluate the candidate's creditworthiness and might provide lower charges and rate of interest prices for those with a good monetary standing. When determining in between the two, individuals must consider the advantages of simpler authorization with safe cards versus the potential prices, and consider unprotected cards for their lasting monetary objectives, as they can assist reconstruct see here now credit history without binding funds in a down payment. Inevitably, the choice in between secured and unsecured charge card should align with the person's financial objectives and ability to handle credit sensibly.

Resources for People Seeking Credit Score Restoring

One beneficial source for people seeking credit score restoring is credit report counseling firms. By functioning with a credit score therapist, individuals can gain insights into their credit rating reports, find out strategies to increase their credit history scores, and obtain assistance on handling their financial resources successfully.

One more practical resource is credit history tracking solutions. These solutions enable individuals to maintain a close eye on their why not find out more debt records, track any kind of adjustments or errors, and identify possible indicators of identity theft. By monitoring their credit rating routinely, people can proactively attend to any problems that may arise and make certain that their debt information is up to date and exact.

Moreover, online devices and resources such as credit history simulators, budgeting apps, and financial literacy web sites can provide individuals with useful information and tools to aid them in their debt rebuilding trip. secured credit card singapore. By leveraging these resources efficiently, people released from bankruptcy can take purposeful actions towards boosting their credit score health and securing a much better economic future

Verdict

Finally, individuals discharged from insolvency may have the opportunity to acquire bank card by taking steps to restore their credit history. Factors such as credit history debt-to-income, background, and revenue proportion play a significant function in charge card authorization. By recognizing the influence of bankruptcy, choosing in between safeguarded and unsafe charge card, and utilizing sources for credit restoring, individuals can improve their creditworthiness and possibly obtain accessibility to credit cards.

By working with a credit history counselor, people can obtain insights right into their credit rating reports, find out techniques to boost their credit ratings, and receive assistance on managing their funds efficiently. - secured credit card singapore

Report this page